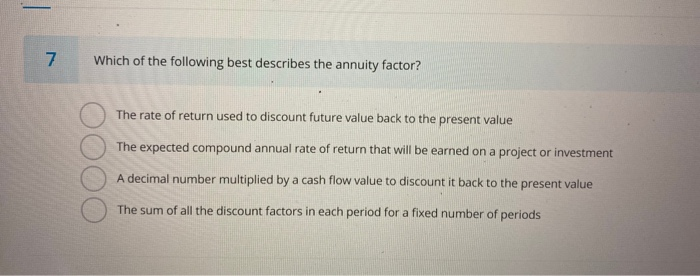

Which of the Following Best Describes the Annuity Period

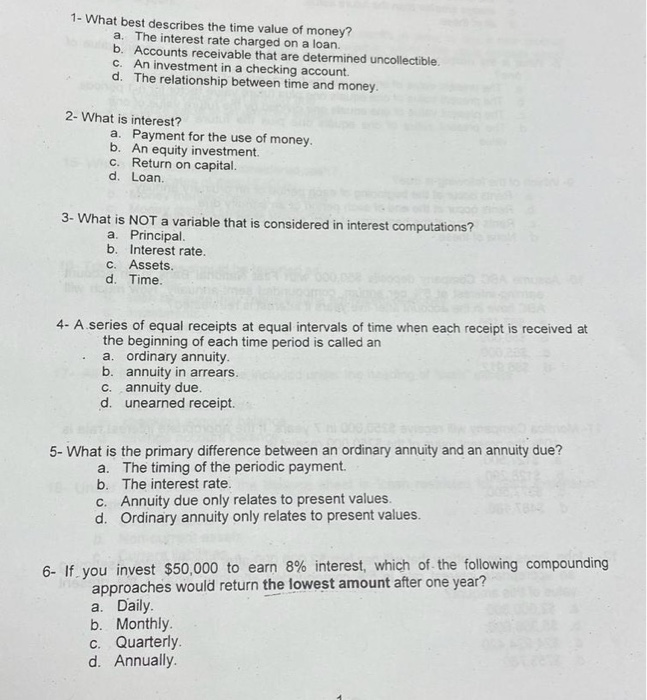

View the full answer. In an annuity the accumulated money is converted into a stream of income during which time period.

Solved If You Need 5 000 In 4 Years Time And Your Chegg Com

It may last for the lifetime of the annuitant.

. The annuity period is. A present value of a perpetuity. Which of the following is TRUE regarding the annuity period.

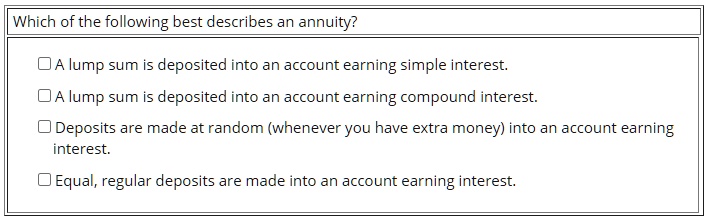

An annuity which provides for payments for the remainder of a persons lifetime is a life annuity. The accumulation phase is the pay-in period during which premiums are paid into the annuity. Equal cash flows at equal time intervals for a specific time period.

The time during which accumulated money is converted into an income stream. A period certain annuity is an annuity that pays out an income stream for a set period of time. Violation of unfair discrimination law may result in all of the following penalties EXCEPT.

How much of the annuity payments are included in income for 2018. Carl is 60 years old. Which of the following best describes what the annuity period is.

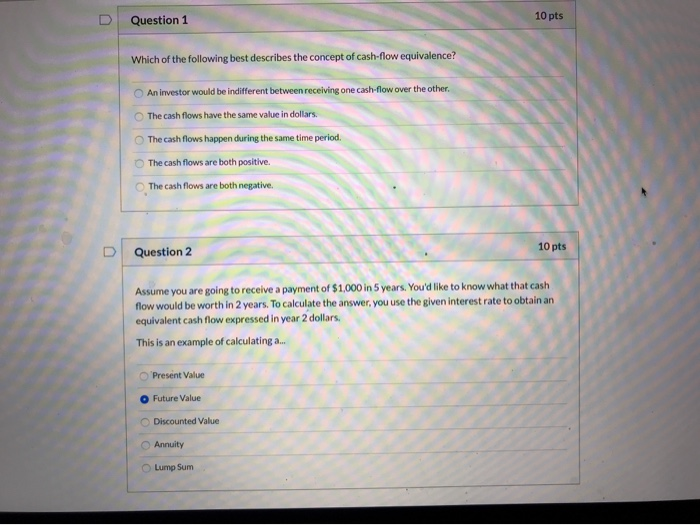

Which of the following best describes the structure of an annuity. During the accumulation phase your funds are invested in fixed or variable accounts that you choose. The present value of a set of.

Payments under the contract began January 1 2018. Annuities are essentially insurance contracts. Examples of annuities are regular deposits to a savings account monthly home mortgage payments monthly insurance payments and pension payments.

In contrast an annuity due features payments occurring at the beginning of each period. What is accumulation phase in mutual fund. The annuity contract provides Carl with payments of 600 per month for the rest of his life.

Multiple Choice C Series of cash inflows of varying amounts collected at the end of each period O Series of cash flows of equal amounts collected at the end of each period Series of cash flows of varying amounts collected at the. Lumpy cash flows at equal time intervals for a specific time period. Lumpy cash flows at equal time intervals forever.

It is the period of time during which the annuitant makes premium payments into the annuity. B The annuity is subject to both state and federal taxation. The accumulation phase always comes first.

The period of time during which accumulated money is converted into income payments. B future value of an annuity. It is also referred to as the accumulation period.

C present value of an annuity. Round the exclusion ratio to four decimal. 18 Which of the following properly describes the future value of an annuity due.

Which of the following best describes the accumulation phase of an annuity. A series of payments to be received at a common interval during a period of time. Equal cash flows at equal time intervals for a specific time period.

A The period of time during which accumulated money is converted into income payments. It is the period of growth for the annuity that begins after the initial investment is made. The annuity is subject to both state and federal taxation.

An annuity is a series of payments made at equal intervals. A The first payment is one period after the present value. C The growth is subject to immediate taxation.

Your client plans to. Which of the following best describes this. Which of the following best describes taxation during the accumulation period of an annuity A The annuity is subject to state taxes only.

Fixed annuities pay the same amount in each period whereas the amounts can change in variable annuities. Annuities provide guaranteed income for life by systematically liquidating the sum of money that has accumulated in the annuity. Which of the following best describes taxation during the accumulation period of an annuity.

Equal cash flows at equal time intervals forever. Any growth on your investment will accrue tax-deferred. Either the amount paid into the plan or the cash value of the plan whichever is the greater amount Term.

The type of annuity and the details of the particular annuity can determine. The payments in an ordinary annuity occur at the end of each period. D present value of a series of non-constant cash flows.

B The period of time spanning from the accumulation period to the annuitization period c The period of time during which money is accumulated in an annuity d The period of time spanning from the effective date of. A The period of time during which accumulated money is converted into income payments b The period of time spanning from the accumulation period to the annuitization period c The period of time during which money is accumulated. Which of the following statements best describes an ordinary annuity.

Secondly how is an annuity paid out. Which one of the following statements best describes an ordinary annuity. During this period of time the annuity payments grow interest tax deferred.

Which of the following best describes what the annuity period is. D Taxes are deferred. Fines of up to 1000 for each act.

The annuity is subject to state taxes only. What best describes the annuity period. On January 1 2018 Carl purchased a single life annuity for 70000.

A life annuity pays an income out for the. All of the following statements are true regarding installments for a fixed period annuity settlement option EXCEPT. An ordinary annuity is a series of equal payments made at the end of each period for a.

1 Answer to Which of the following best describes what the annuity period is. Click to see full answer. A series equal payments to be received at a common interval during a period of time.

You pay a set amount of money today or over time in exchange for a lump-sum payment or stream of income in the future. The law that protects consumers against the circulation of inaccurate or obsolete information is known as. The growth is subject to immediate taxation.

A series of payments to be received during a period of time. Which of the following best describes what the annuity period is. In this regard what is an annuity due.

Solved 1 What Best Describes The Time Value Of Money A Chegg Com

Solved D Question 1 10 Pts Which Of The Following Best Chegg Com

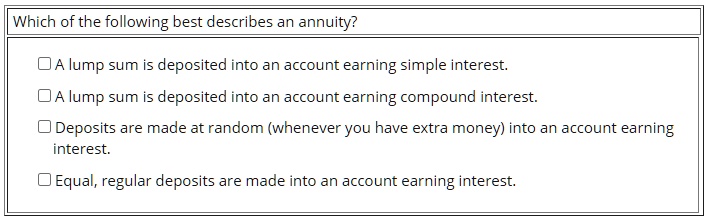

Solved Which Of The Following Best Describes An Annuity Oa Lump Sum Is Deposited Into An Account Earning Simple Interest Oa Lump Sum Is Deposited Into An Account Earning Compound Interest Deposits Are

No comments for "Which of the Following Best Describes the Annuity Period"

Post a Comment